ARCBA White Paper - A response

It was great to see the Australian Real Craft Beer Association release their white paper Australian Real Craft Brewers and the need for excise relief and Government support. It is clear from the paper that a significant body of work has gone into the preparation of the paper. The call for excise relief is an important one and action needs to be taken and it’s fantastic to see an industry body lead the way.

As highlighted in the white paper there are many reasons for excise reform that go beyond simply providing support to small craft breweries around Australia. Some of the key points from the paper are below:

1. Excise reform needs to be undertaken to support small independent brewers to address the differences in taxation:

a. of alcohol in Australia versus other OECD nations and this is hurting local small breweries, and

b. between beer and wine in Australia

2. Further funding to support small independent breweries should be provided by:

a. Offering excise relief to small breweries beyond the current excise rebate

b. Providing funding for quality training and testing

c. Providing investment grants offering matched funding

d. Further funding to support and develop export markets

While it is clear that excise reform is required, the above points unfortunately miss some key information. At its very base level, the taxation of alcohol in Australia versus other OECD nations is largely irrelevant for the domestic market and for exports. Imports are subject to the same levels of taxation as local products and they have the additional cost of freight to get here. To suggest that imports of craft beers is damaging the local market on the basis of taxation misses the point. However, a key point that can be made, and is made in the white paper, is that if a small brewery has more funds to spend on its capital equipment, quality testing and growth it will be a stronger business. A stronger business is then better able to compete.

But it is important to note they are not competing on price because of excise alone. They compete on the quality of the product and with the Australian dollar as it is now. Great beer will win the consumers heart regardless of its origins. I know from my own personal experience that any problems with the beer you sell hurts your brand, and venues and consumers will quickly return to what they ‘know’.

On the issue of the disparity between taxation of beer and the taxation of wine there is a clear case for reform. But it must be acknowledged that the support for the wine industry remains because of the importance of the wine industry to the Australian economy as a whole.

The wine industry has done a very good job over the years of outlining its importance. A large portion of wine produced is exported. It is a significant employer in rural areas and it has a strong political voice with clear statistics to support its claims. Interestingly, it is this same point that supports the claim for an excise rebate/relief for small breweries. However, that is somewhat simplistic at this point. Supporting small businesses in any area will build a network of small business employers well placed to grow. There needs to be a strong case for reform on this point. Highlighting that wineries received a benefit that breweries don’t get won’t be enough.

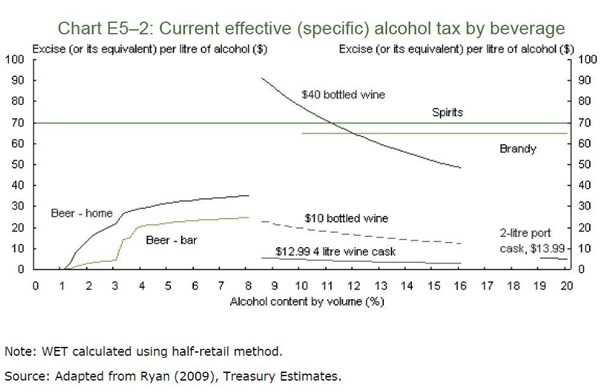

Taxation of alcohol as a whole is a complex matter and there are many threads that impact the whole. The taxation of alcohol combines the support for some industries (wine including cider), particularly smaller producers, that are considered to support the economy while still imposing significant taxation of larger wine makers. The taxation of spirits and ready to drink (RTD’s) beverages and, to a lesser extent, beer is in recognition of the significant cost to society alcohol causes. Taxation of alcohol as a whole is high as a result of the significant demand on society’s resources to deal with the impact of alcohol. In addition, demand for alcohol is rarely significantly impacted by price increases. Taking all of this into account a significant decrease in excise is unlikely even for small breweries without a strong argument to support the change.

There is a need for reform. The nature of the reform being sought will impact the success of that call for reform.

A simple rebate for small breweries is a costly handout without clear statistics that support the need and the benefit of that rebate. Further work needs to be done here. The white paper makes some good statements around the potential growth and additional taxes and benefits that can be drawn from supporting small breweries. But further work is required. More modelling of local breweries and demonstration from a local company that, if they received an additional level of funding, they forecast growth.

As a small brewing company, I can see that if I received an excise rebate covering my excise cost I would be better able to compete on price in some venues. But that is also only part of the story, there will still be a number of venues that would not take on my beer because their customers wouldn’t want to drink it. The venues also may not want to add another supplier to their already long list, they may have concerns about the quality of the product compared to the larger breweries. It’s a step, but there are other factors. Modelling, forecasting and budgeting, research to further support changes all add strength to the claims for more support for small breweries.

The white paper also calls for funding for quality training and testing, matching grants and export support. There is a need for quality training and testing and it is critical. This supports the industry as a whole. There are potential ways forward in this regard. Can government testing facilities be made available such as those at universities, perhaps the CSIRO, or TAFE?

The real question is though, if the facilities already available aren’t used, where does this funding go? There needs to be a craft beer industry body that can drive this forward, that can demonstrate that it has the knowledge, the network and the facilities, or the ability to obtain the facilities, to support the industry as a whole. This is not necessarily an excise related issue but it could be tied to the excise issue. Through genuine excise reform, the excise take for the government could be maintained, and funding for training and quality testing could be achieved.

With respect to matching grants and export grants, there is little doubt the Government will point to the large number of grants and benefits that it already provides to small businesses in this regard. Whether they are simple grants or incentives, loan schemes or competitive grants, there is a significant level of support to small businesses already at both the federal and the state level. While they may not be craft beer specific they are there. Programmes such as the Export Market Development Grant have long supported the development of export markets, there are programmes supporting innovation and commercialisation. There is also the T-QUAL grants to support tourism. It is up to the relevant industry bodies to be aware of these programmes and provide support in knowing what is available and how to apply.

The white paper is a well-researched and presented paper so where to from here? There needs to be a continued push for reform, genuine reform. Funding for quality training and testing needs to have a way forward, asking for funding isn’t enough but building a case as to how that money will be spent is necessary. The next step on excise reform should, in my view, involve:

- Demonstrating the benefits, improved quality local beer means more local sales, potentially less imports as consumers choose quality local products and possibly more exports but these points need to be demonstrated and modelled. Case studies need to be developed but consider the below table which is but one of many options available.

- working with health lobby groups and other groups looking for changes to the excise system. Bring together the voices of the brewers, their customers and other lobby groups with an interest in excise reform. Health lobbyist want to see excise reform to acknowledge the cost to society of alcohol.

- focussing on the quality of the product, reduced consumption,and

- seeking full excise reform. Excise reform is necessary, and the best option would be a move to a volumetric tax of alcohol without distinction for alcohol type or the size of container the beverage is sold as outlined in the Henry review, as sought by health lobby groups, by the brewing industry. While this may result in an increase in excise at base rates for beer at some level a tiered tax system would help and small business concessions could be worked into the system to benefit all alcohol producers. These are the concessions that must be fought for, not tweaking the current system to prop up businesses that aren’t profitable and can’t survive without a government hand out.

- There are a number of concessions that microbreweries could seek in the new environment including an expansion of the current micro-brewing concession, business start up concessions, exemptions from excise up to certain volumes produced, exemptions for producers selling their product through their cellar door or restaurant. These types of concessions are more likely to win support and would be easier to achieve in the event of genuine excise reform but some of them may be low hanging fruit. There is a need to examine the cost and examine the benefits of these options.

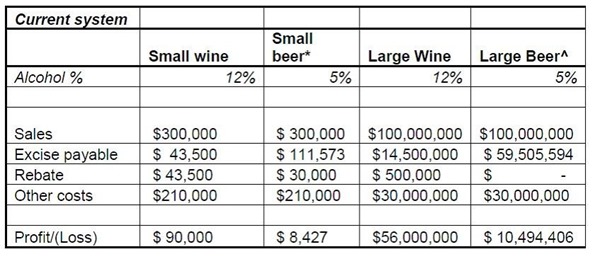

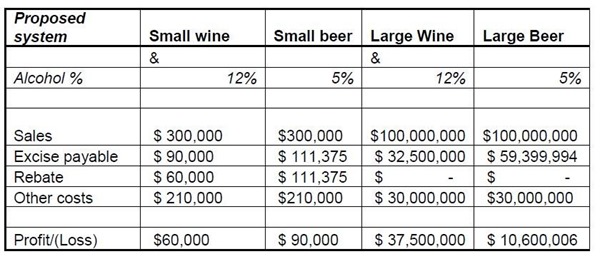

The attached, very rough, case study demonstrates a revised excise system that adopts a tiered system. It considers only bottled product. Table 1, shows the current system.

Table 2 shows the proposed system.

A rebate is offered for small producers but the rebate is capped at 8% alcohol to encourage lower alcohol products. But an alternative would be to adopt a flat rebate across the board that is capped at a fixed level of alcohol per producers. The rebate in this example also adopts a cap of this sort capping the rebate at 15,000LALs. There is an impact for wine producers but is must be noted the impact would only be for domestic sales. The majority of wine produced in Australia is exported and such any impact will be lessened.. It is one of many options available.

The final attachment shows a table on tax and alcohol from the Henry review in 2009.

Alcohol taxation will forever be something part of the tax system, there is no avoiding it. But it should be simpler and easier to understand. Once a simple base tax is achieved then concessions can be targeted to the areas which should be supported such as the small producers. It is not an issue for just small beer producers but for all small producers and the broader community.