NoLo trade marks outpace category growth

As media attention on Dry July enters full swing, recent trade mark activity suggests a continued surge of entrants for the NoLo category.

During the three-month period of April to June 2022, 364 trade marks were lodged and accepted by IP Australia in Category 32 (Beer) with 67 of these listed as no-alcohol.

The rapid deployment of no-alcohol products is well documented and these numbers showcase how many businesses continue to pursue this trend.

However, despite the hype around the category, the growth in new entrants appears to outpace the growth in the market.

In 2016, AB-InBev claimed its no and low alcohol beer products (NABLAB), which is 3.5% alcohol or below, according to the company, would represent at least 20 percent of its global beer volume by the end of 2025.

In the company’s 2021 Environmental, Social and Governance report, it announced that it was “not on track” and would miss this target.

“We are a little over 6% still,” chief sustainability officer Ezgi Barcenas told Reuters in May.

“What we really want to do is provide the consumer with choice and information,” she said.

“At the time this was announced, we didn’t have the availability of choice. We want to focus on the choice as opposed to push the volume out.”

While this goal was originally made to support the World Health Organisation to reach its target of cutting harmful drinking by 10 percent in every country by 2025, it appears global NoLo growth numbers are much lower.

According to a study from research firm IWSR Drinks Market Analysis, NoLo alcohol beverages, including beer, cider, wine, spirits and ready-to-drink (RTD) products, held a 3.5 percent volume share in 2021.

The same study also suggested NoLo companies targeting a nightlife market have “found it tougher to gain consumer acceptance” with five to six percent of NoLo consumers drinking it after 11pm.

“The no/low alcohol market is still very much in its early growth stage in many categories and geographies, as the sector continues to define itself,” COO of IWSR Drinks Market Analysis Emily Neill said in a media release.

“Brands that will ultimately dominate in the no/low space are those that are successful in navigating the barriers of taste, price, pack format, availability, and overall consumer education.”

AB-InBev has reached its 20 percent target in countries such as China and Panama, according to its report, which also shows an increase in its no-alcohol portfolio from 26 to 42 brands over the last six years.

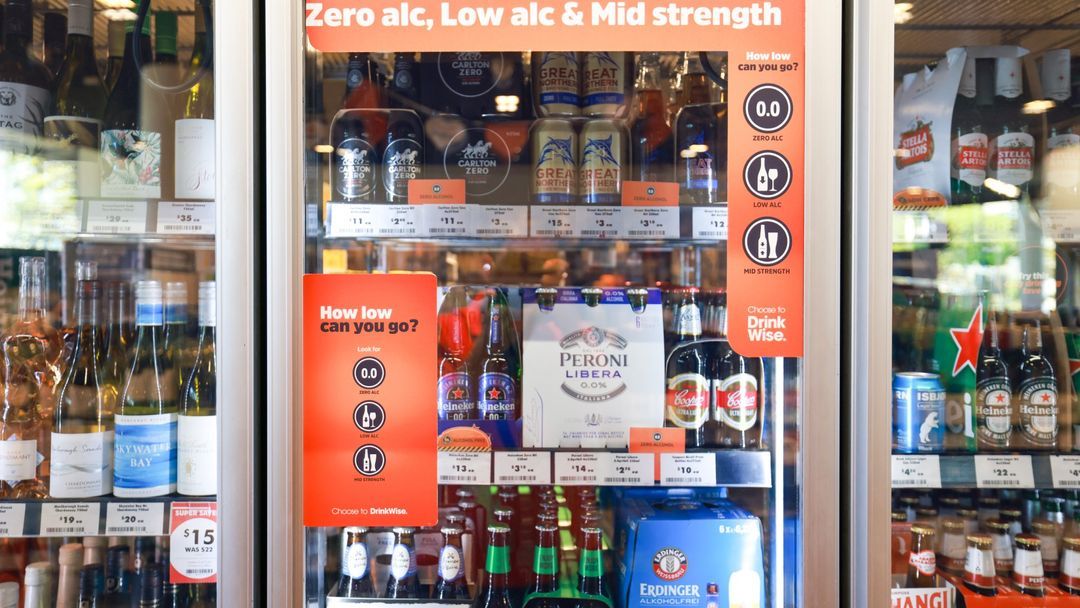

In Australia, Endeavour Group, owner of BWS and Dan Murphy’s, recently claimed that sales of no-alcohol products had grown more than 150 percent in the last 24 months, with the company committing to “offer the biggest zero alcohol range across its network.”

That growth however has come off a very small base and follows significant media interest in the category and heavy investment in the category.

Many smaller businesses have also announced NoLo initiatives to coincide with Dry July.

No-alcohol company Heaps Normal announced a specific campaign called the “Do Your Best” campaign which includes a competition incentivising consumers to submit a story where they were “doing their best” to win a prize of a custom jetski and cash.

Capital Brewing Co. released its first no-alcohol beer, Alc-Less, while seltzer brand FELLR announced FELLR free – a non-alcoholic version of its existing seltzer product. Both products launched on 1st July this year.